How to Deposit and Trade CFD instruments (Forex, Crypto, Stocks) at IQ Option

How to Deposit Money at IQ Option

You are welcome to deposit using a debit or credit card (Visa, Mastercard), Internet banking or an e-wallet like Skrill, Neteller, Webmoney, and other e-wallets.The minimum deposit is 10 USD/GBP/EUR. If your bank account is in a different currency, the funds will be converted automatically.

Many of our traders prefer using e-wallets instead of bank cards because its faster for withdrawals.

Deposit via Bank Cards (Visa / Mastercard)

1. Visit IQ Option website or mobile app.2. Login to your trading account.

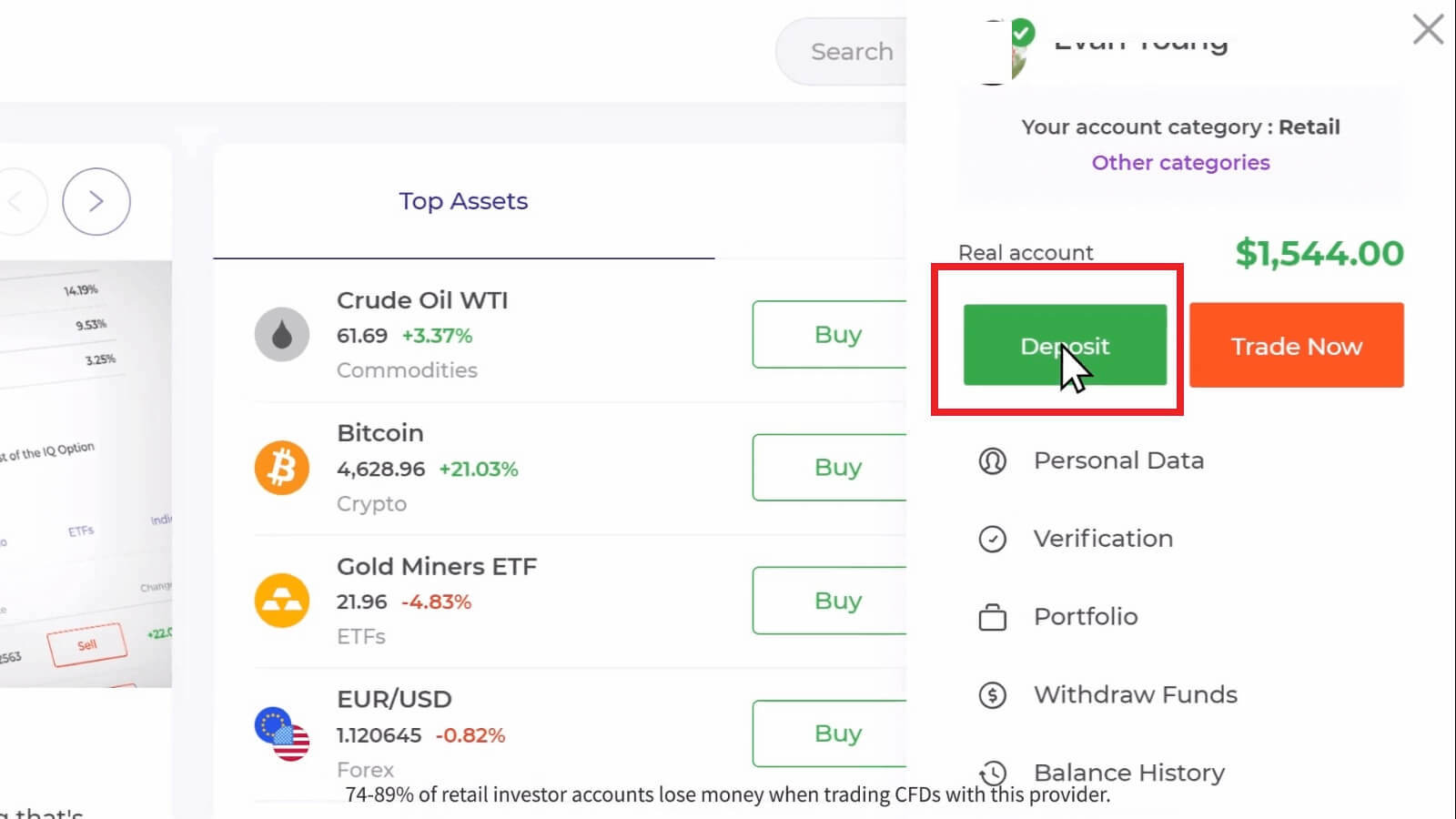

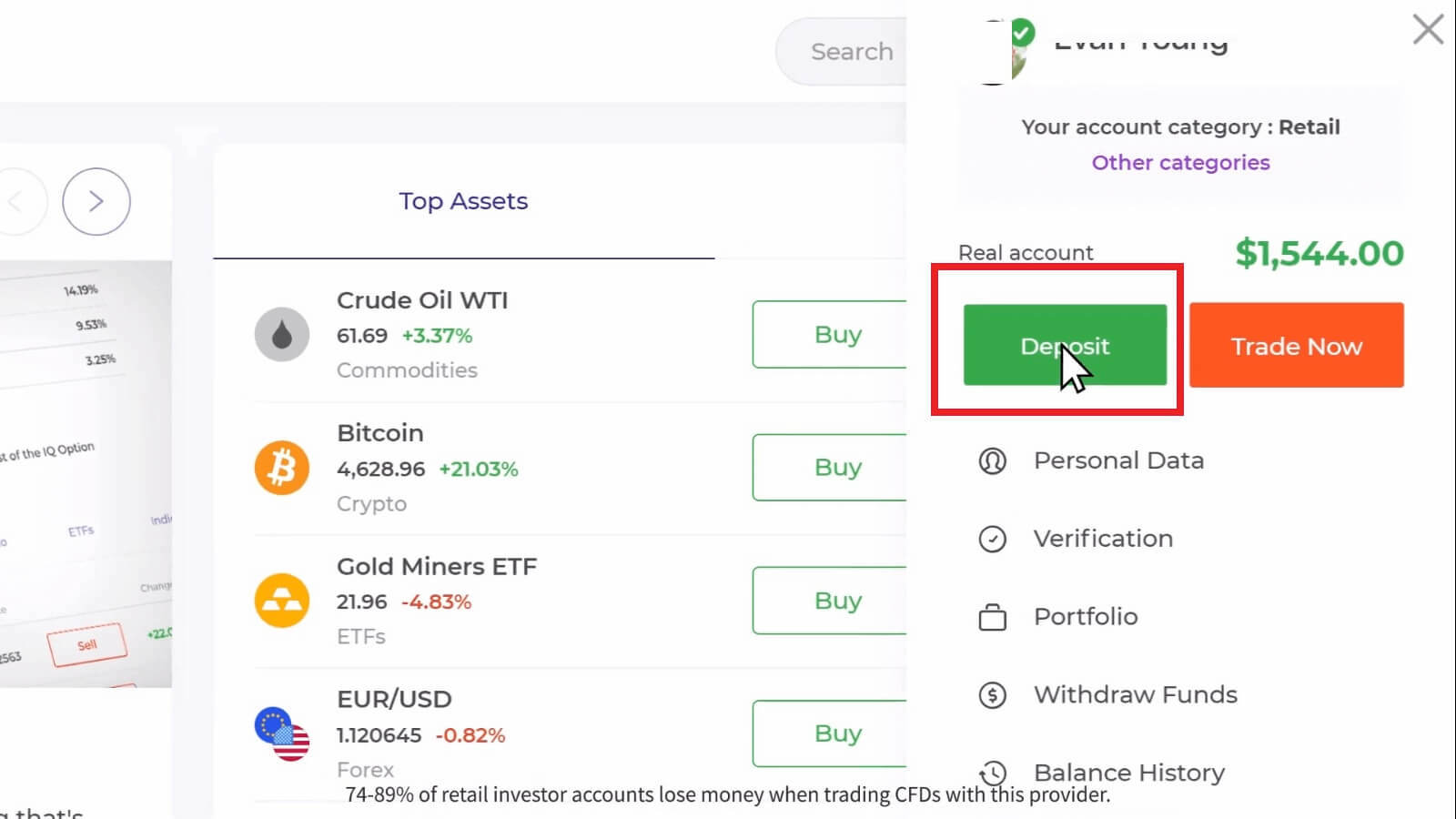

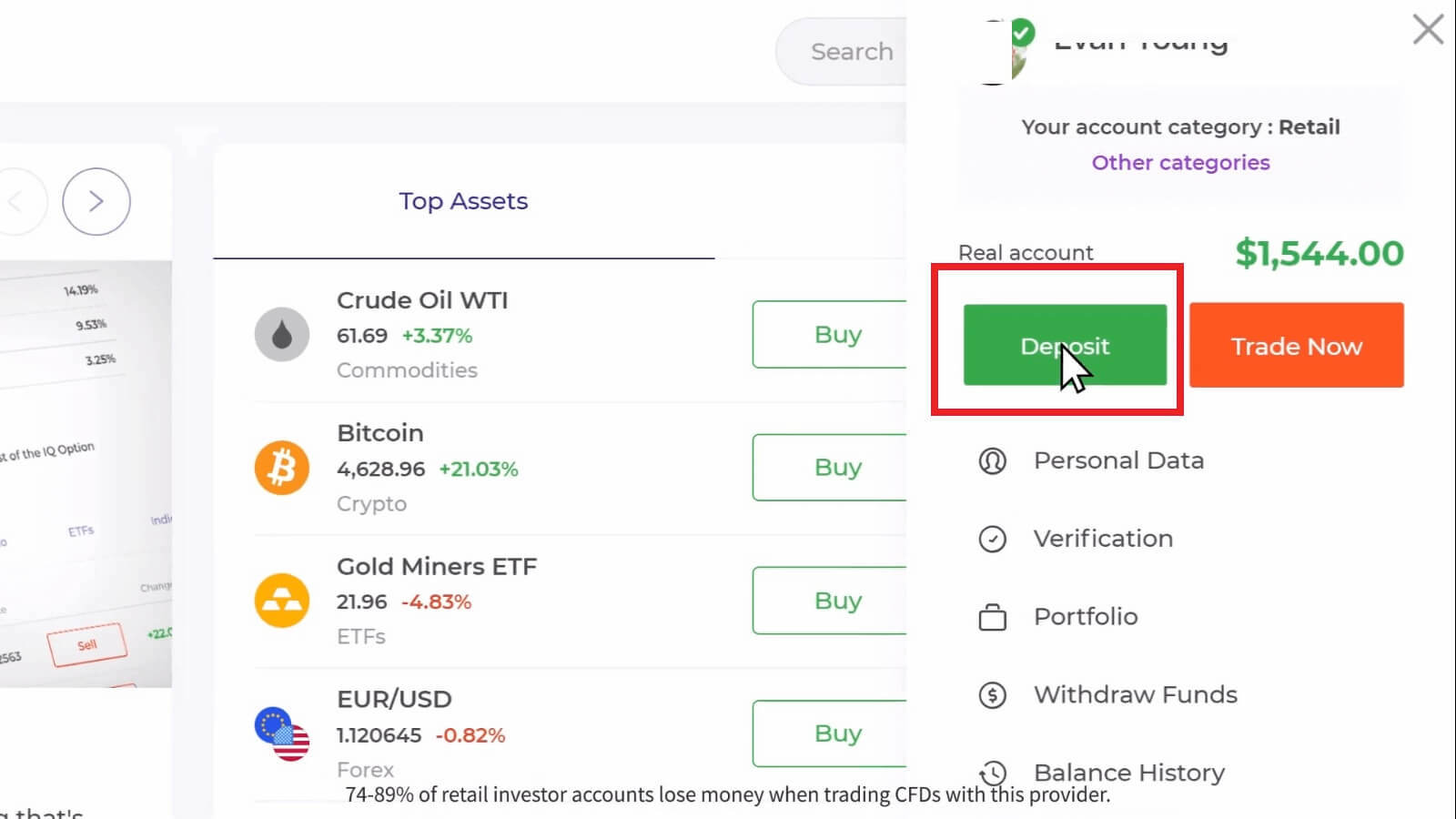

3. Click on the “Deposit” button.

If you are in our home Page, press the "Deposit" button in the upper right corner of the main website page.

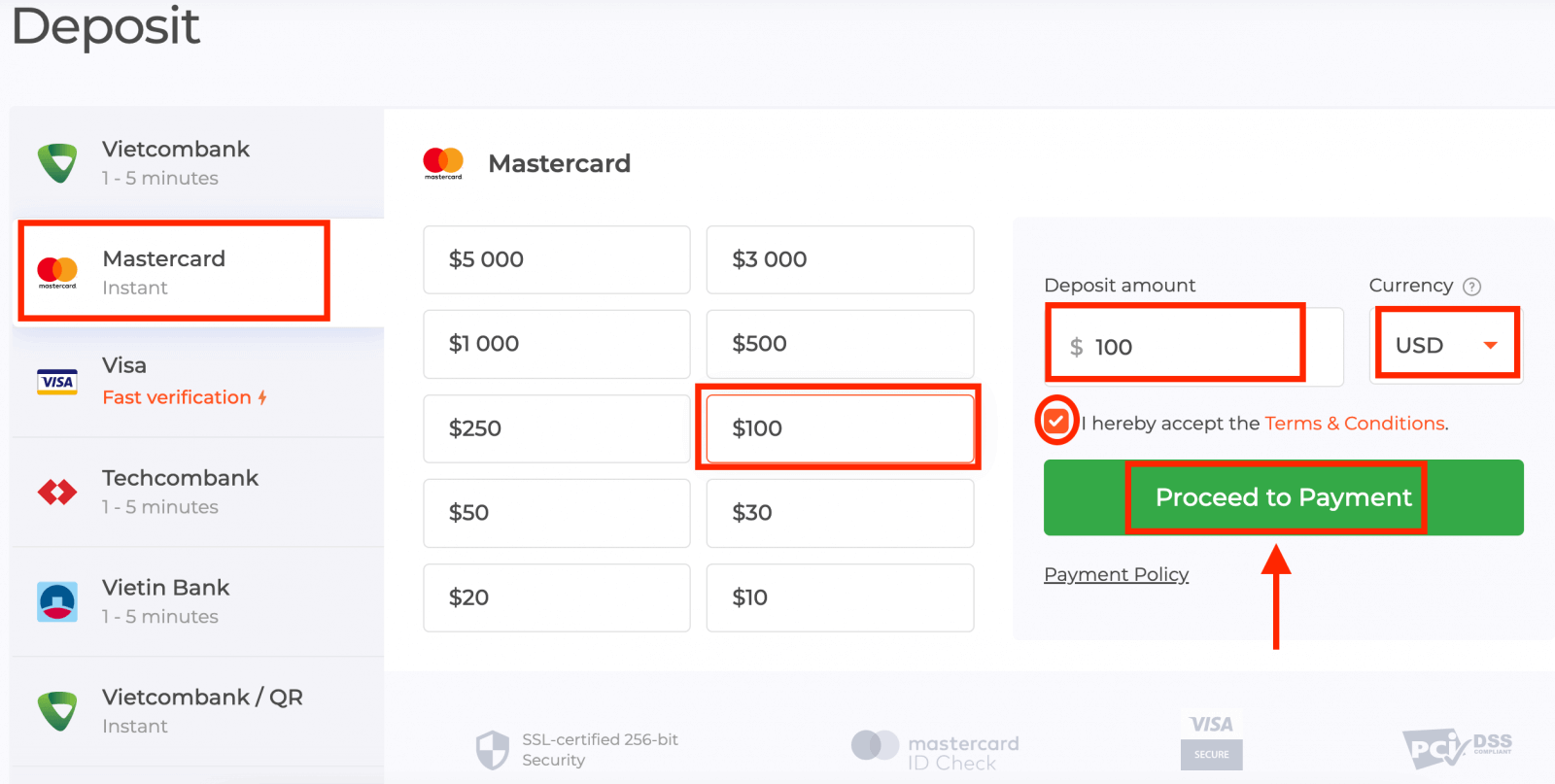

Select the "Mastercard" payment method, enter a deposit amount manually, or select one from the list and click "Proceed to Payment".

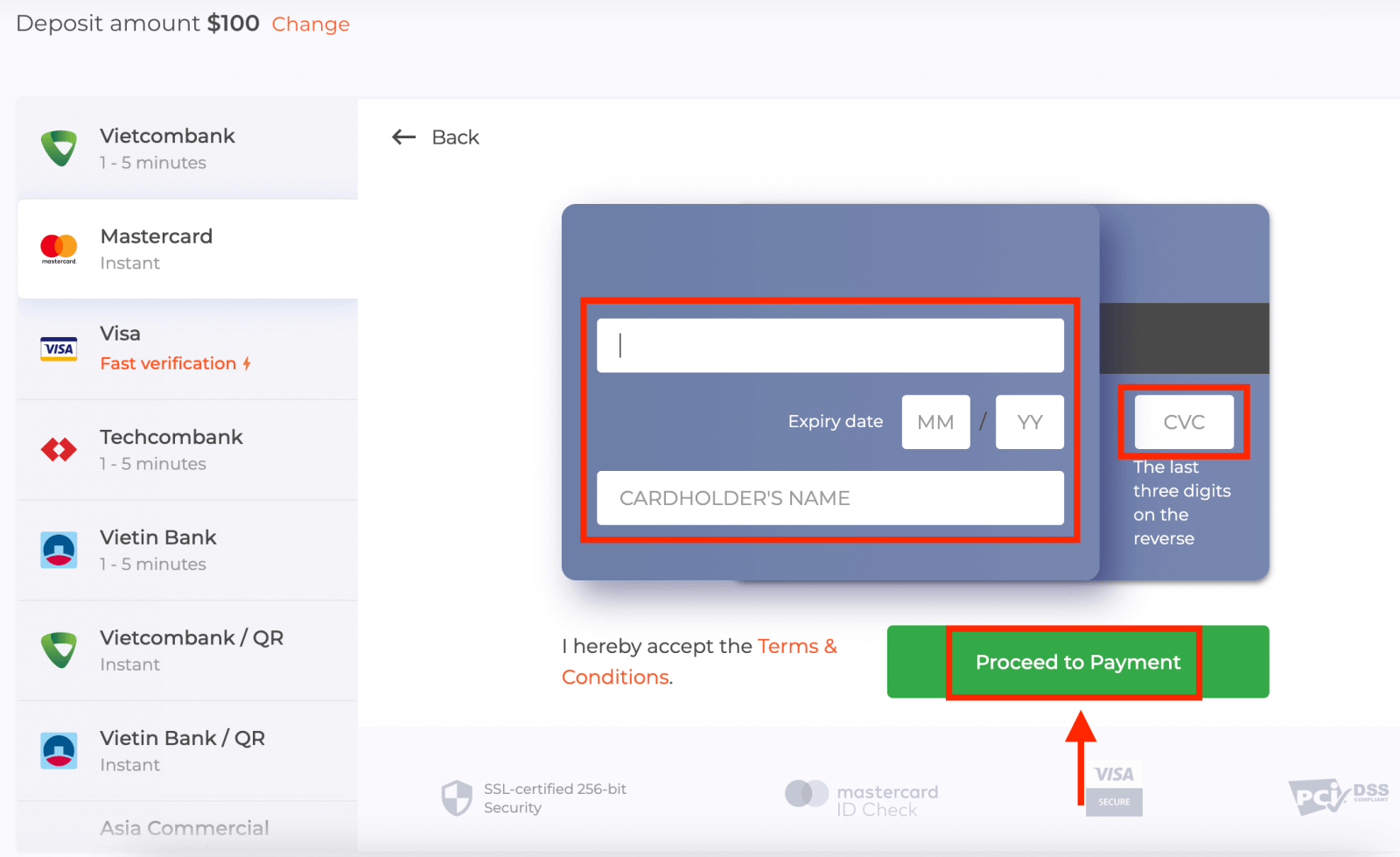

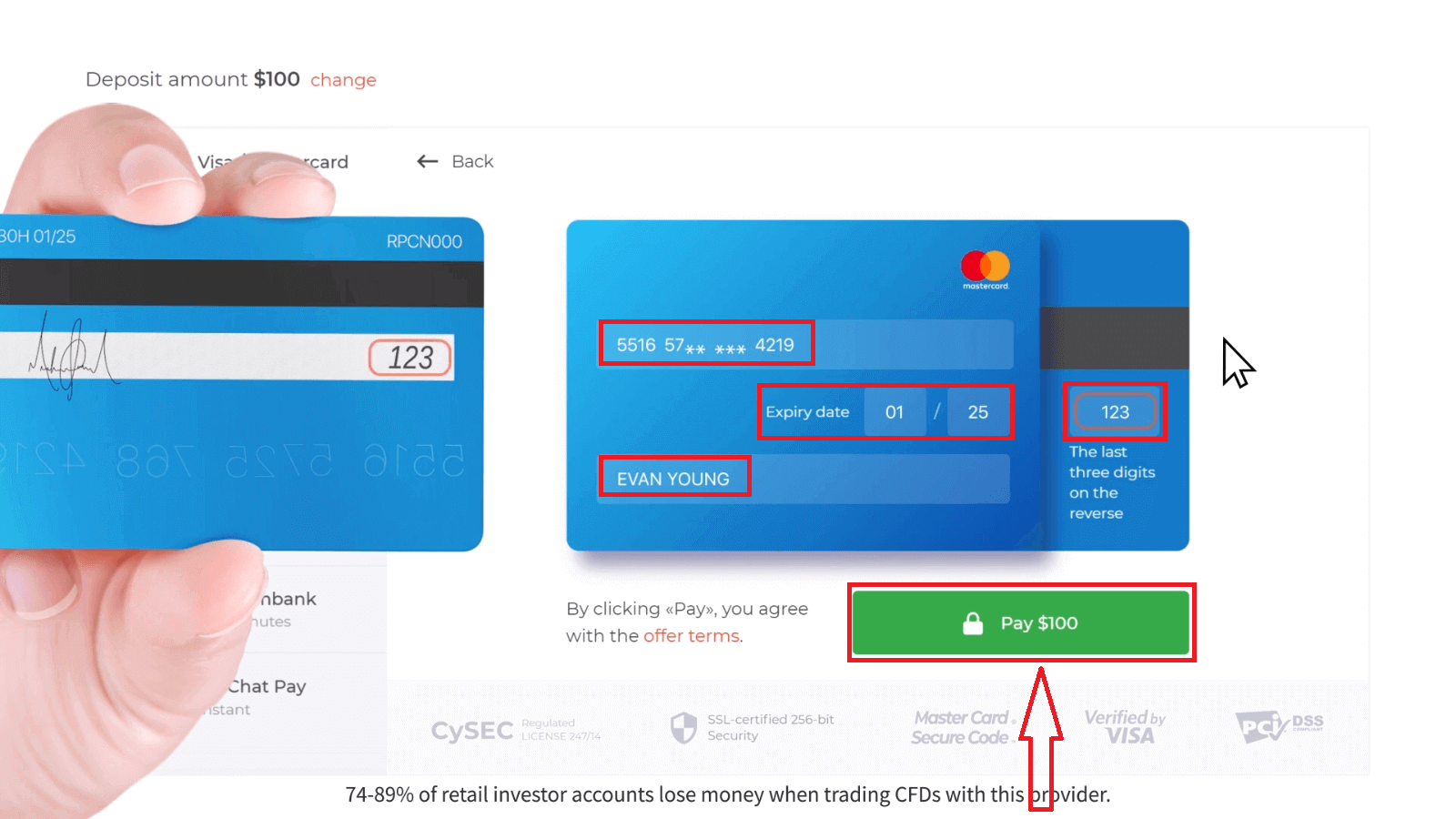

5. You will be redirected to a new page where you will be requested to enter your card number, cardholder name, and CVV.Payment methods available to the reader may be different. For the most up-to-date list of available payment methods, please refer to the IQ Option trading platform

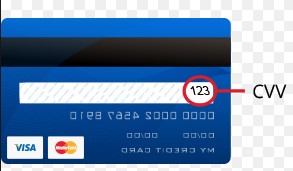

The CVV or СVС code is a 3-digit code that is used as a security element during online transactions. It is written on the signature line on the back side of your card. It looks like below.

To complete the transaction, press the "Pay" button.

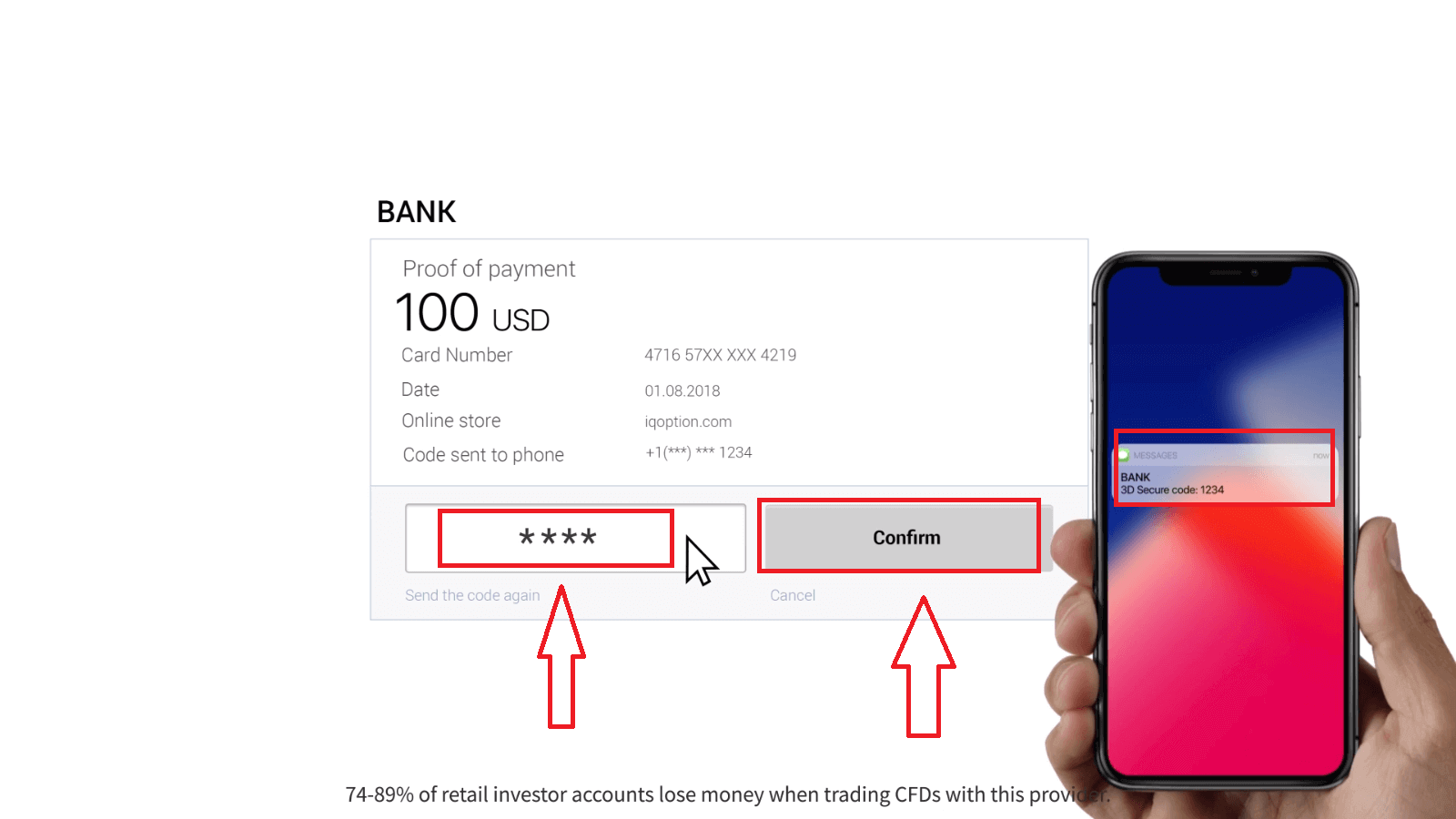

On the new page that opened, enter the 3D secure code (a one time password generated to your mobile phone that confirms the security of the online transaction) and click the "Confirm" button.

If your transaction has been completed successfully, a confirmation window will appear and your funds will be credited to your account instantly.

When making a deposit, your bank card gets linked to your account by default. Next time you make a deposit, you wont have to enter your data again. You will only need to choose the necessary card from the list.

Deposit via Internet Banking

1. Click on the “Deposit” button.If you are in our home Page, press the "Deposit" button in the upper right corner of the main website page.

If you are in the trade room, press on the green ‘Deposit’ button. This button is located at the top right corner of the page.

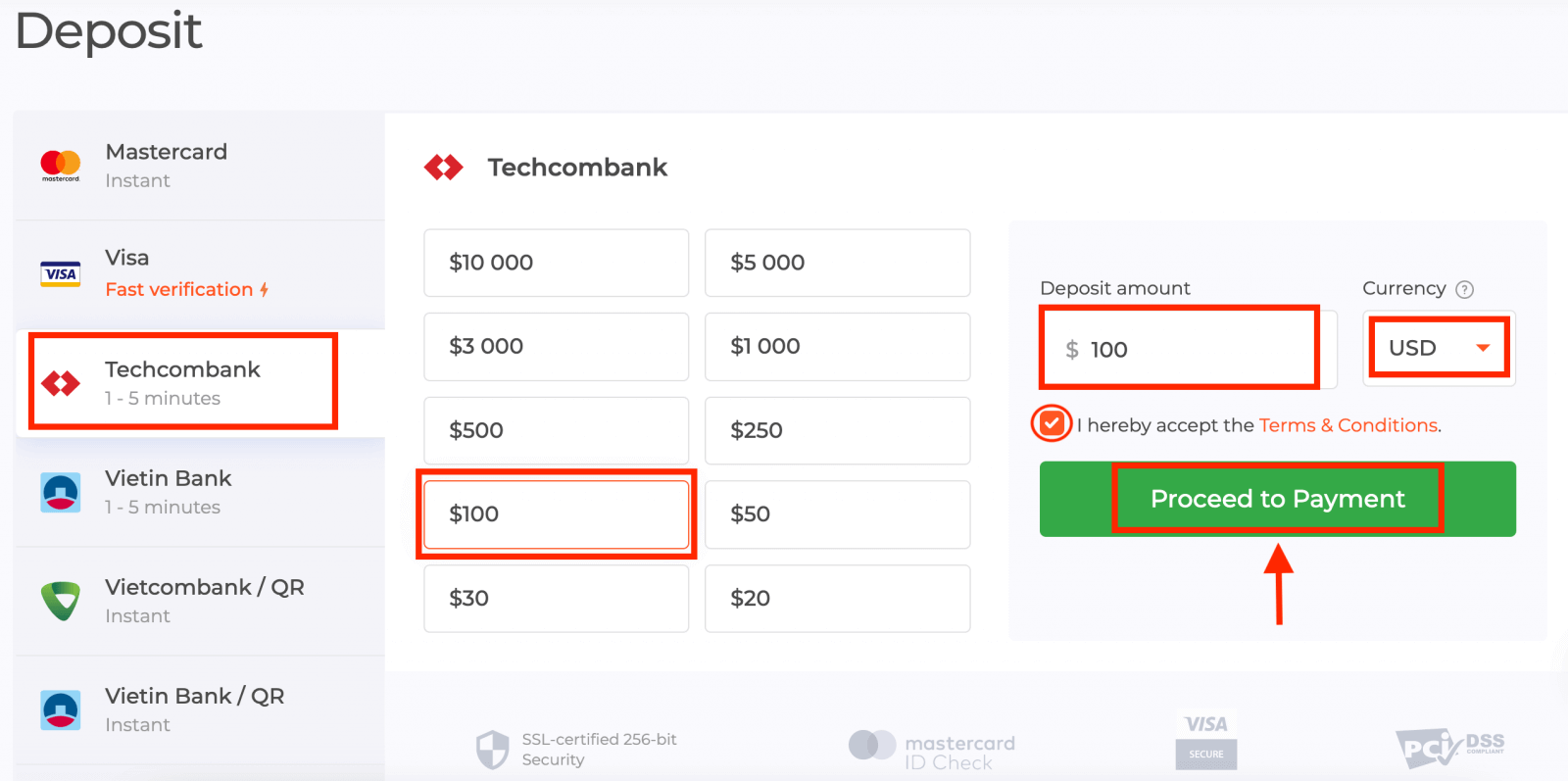

2. Select the bank you would like to deposit (in our case it is Techcombank), then you may enter a deposit amount manually or select one from the list and press "Proceed to Payment".

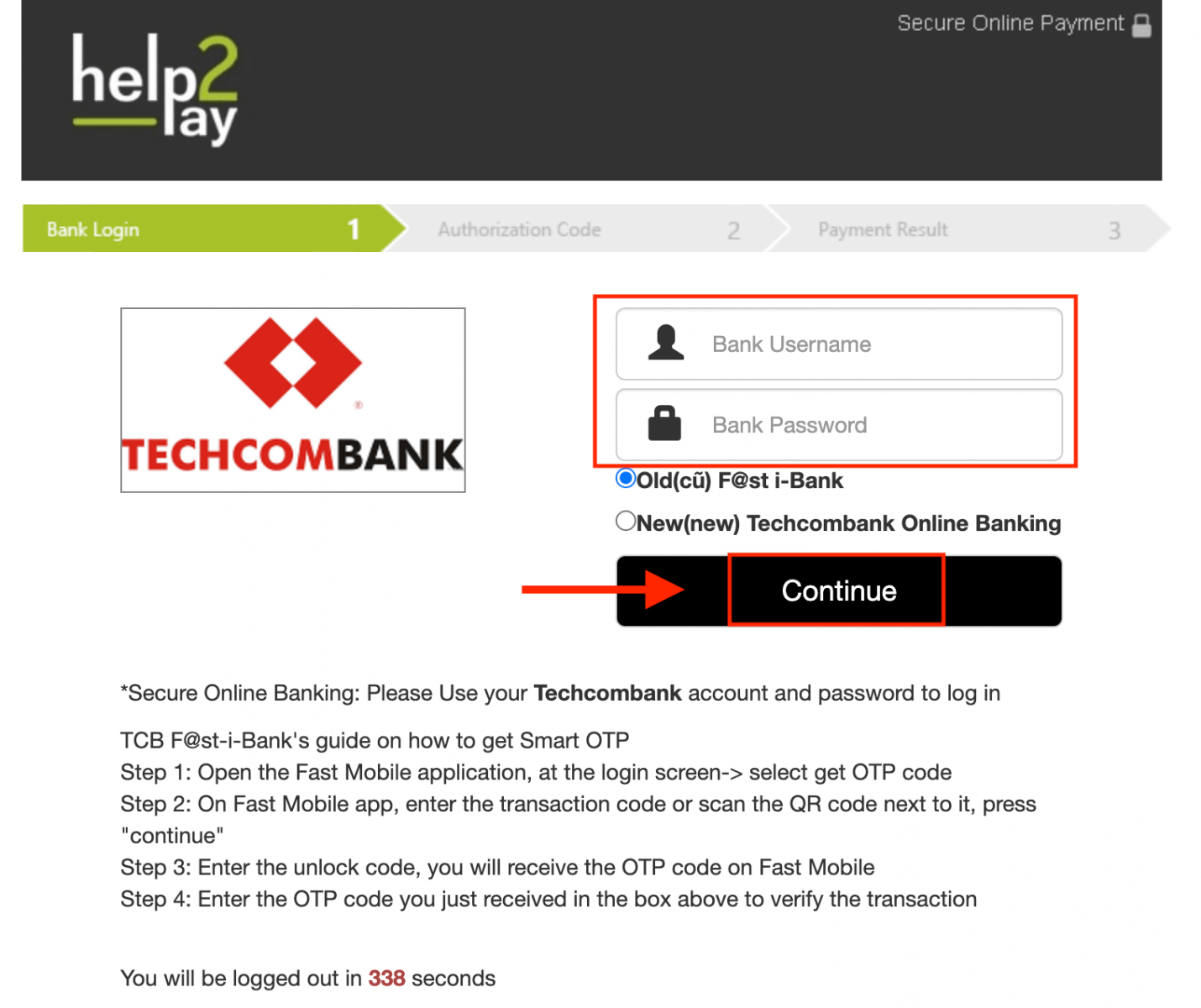

Enter your bank account username and password and click on the “Continue” button.

Note: you have to complete the operation within 360 seconds.

3. Please wait while the system is connecting to your bank account and do not close this window.

4. Then you will see the transaction ID, that will help to get the OTP on your phone.

It is very easy to get the OTP code:

- click on the “Get the OTP Code” button.

- enter the transaction ID and click the “Confirm” button.

- receive the OTP code.

5. If the payment was successful you will be redirected to the following page with the amount of the payment, date and transaction ID indicated.

Deposit via E-wallets (Neteller, Skrill, Advcash, WebMoney, Perfect Money)

1. Visit IQ Option website or mobile app.2. Login to your trading account.

3. Click on the “Deposit” button.

If you are in our home Page, press the "Deposit" button in the upper right corner of the main website page.

If you are in the trade room, press on the green ‘Deposit’ button. This button is located at the top right corner of the page.

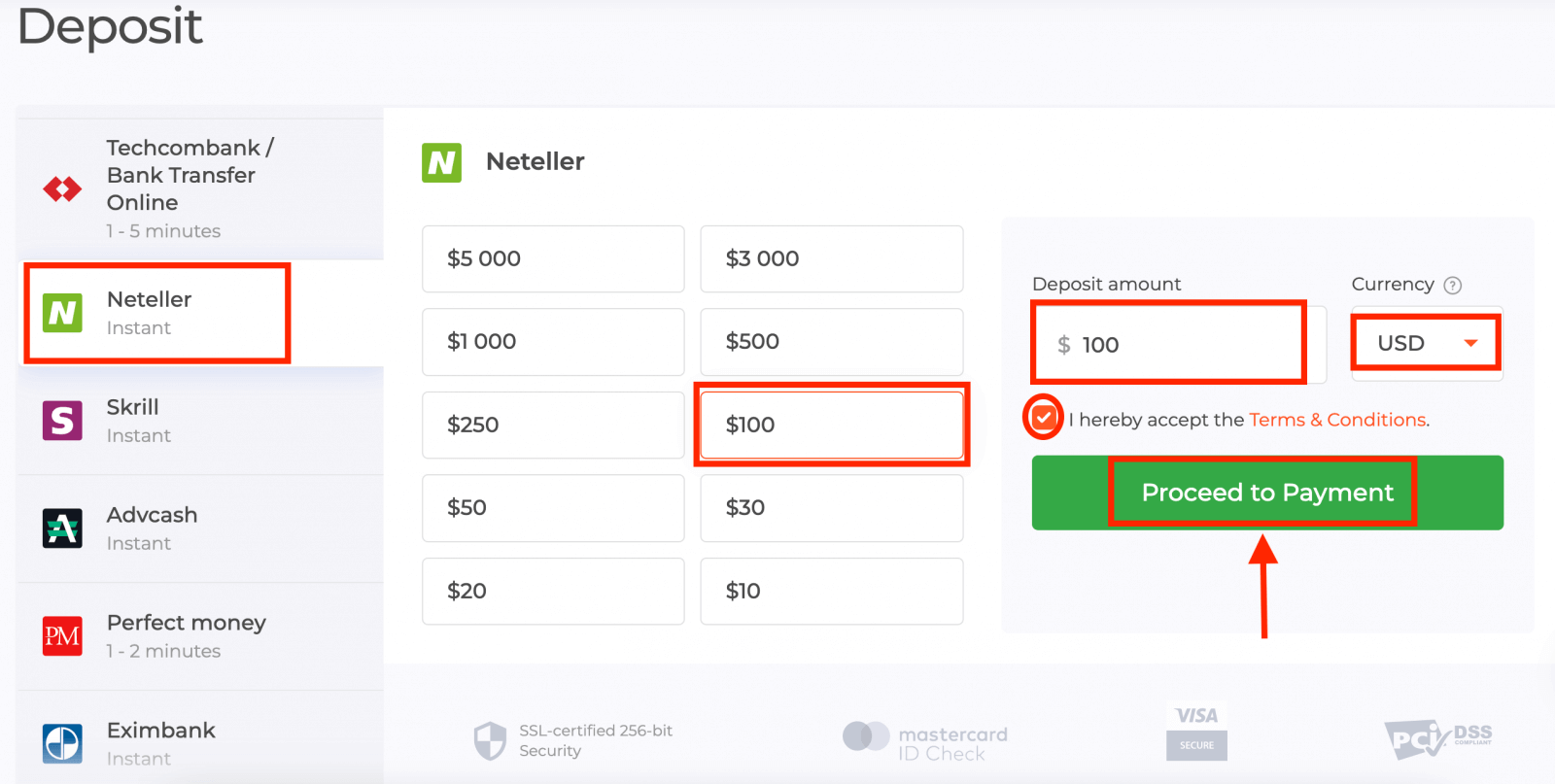

4. Select "Neteller" payment method, then you may enter a deposit amount manually or select one from the list and press "Proceed to Payment".

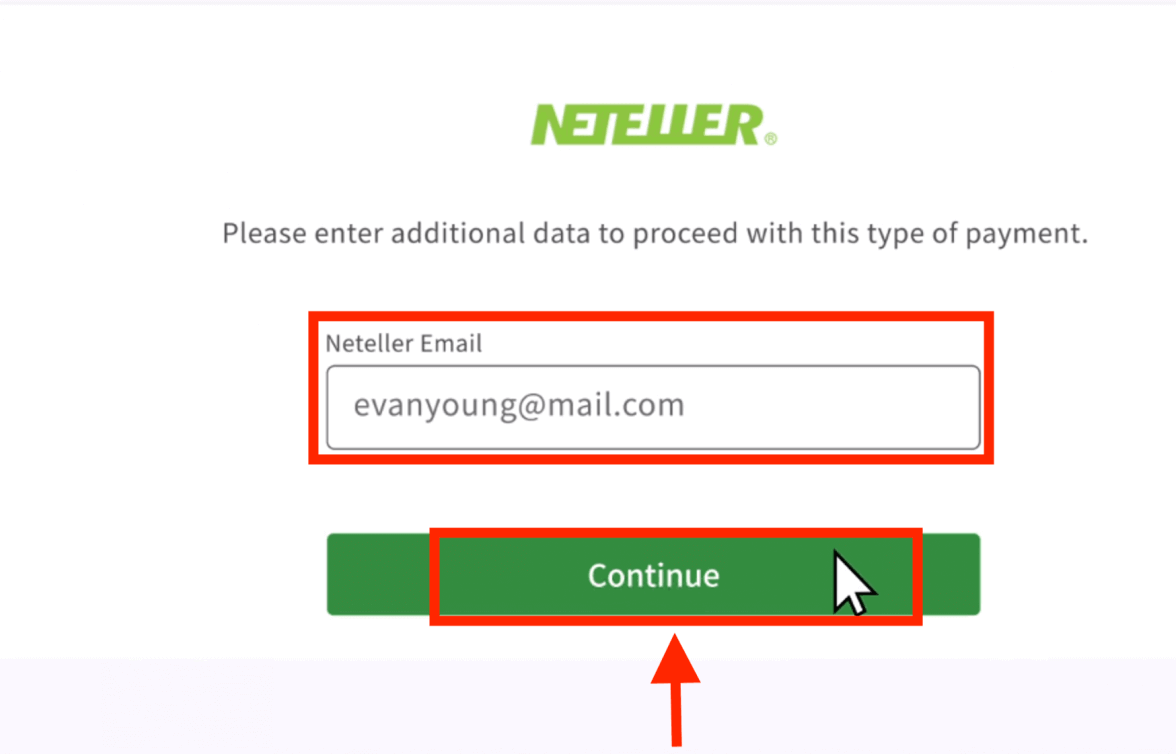

5. Enter the email address you used to sign up with Neteller and press "Continue".The minimum deposit is 10 USD/GBP/EUR. If your bank account is in a different currency, the funds will be converted automatically.

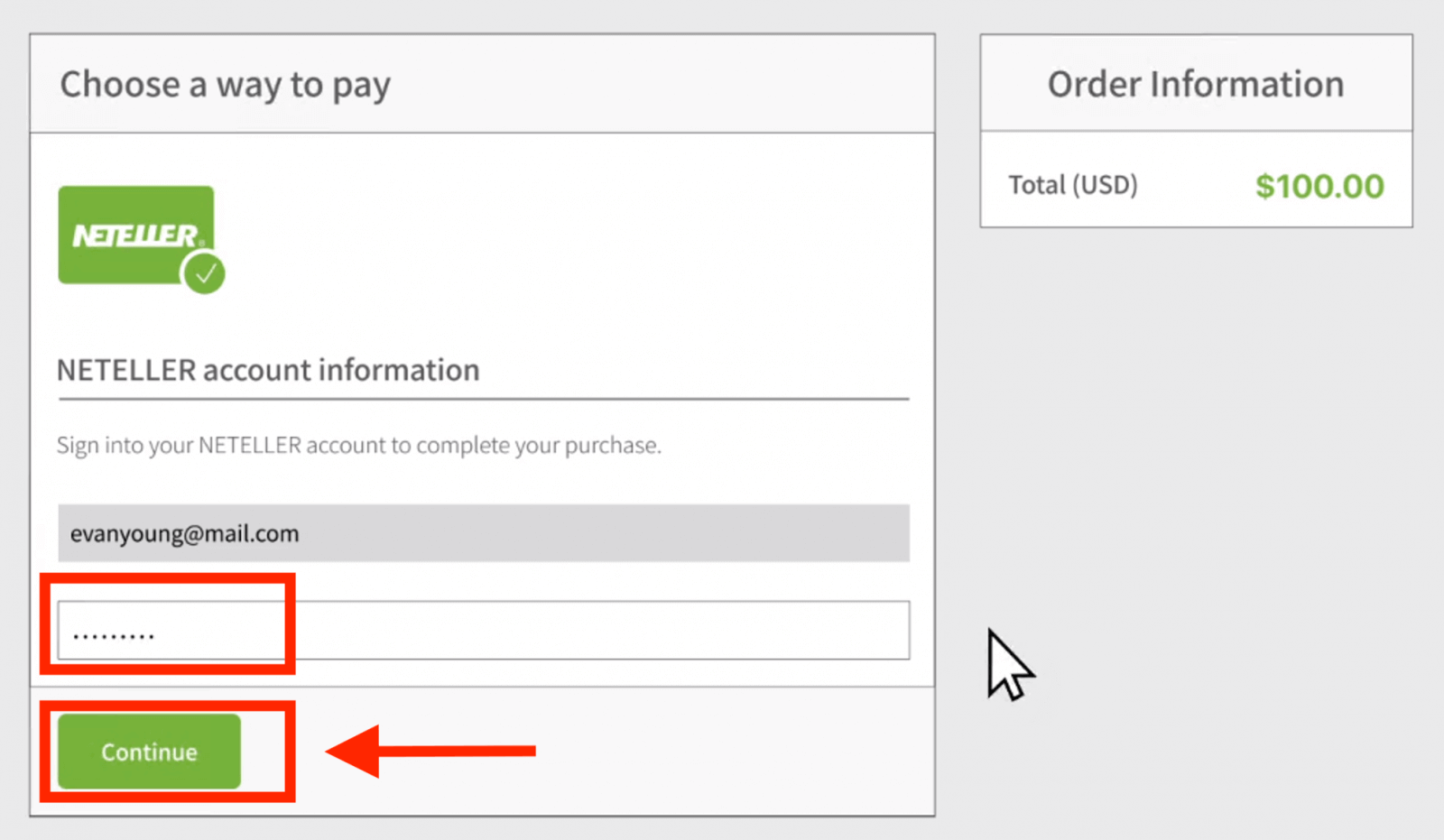

6. Now enter the password of your Neteller account in order to sign in and press "Continue".

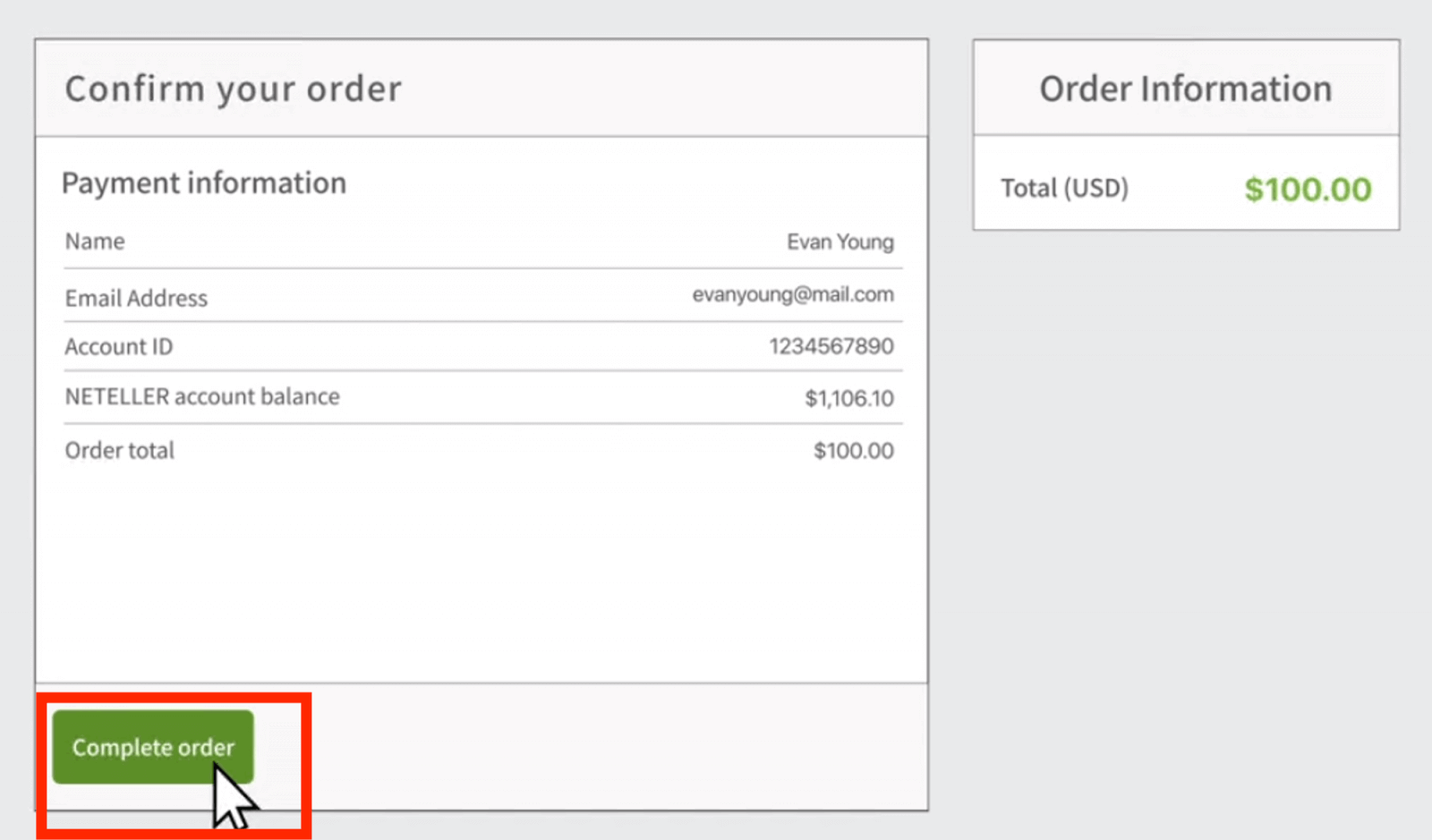

7. Check the payment information and click "Complete order".

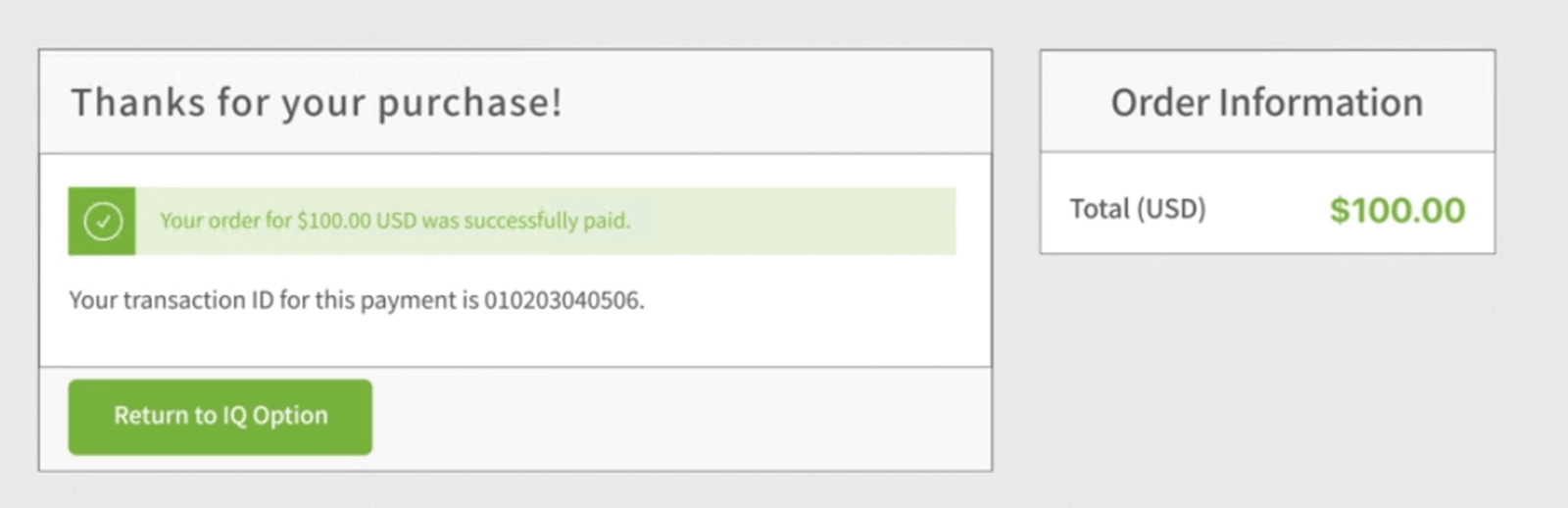

8. Once your transaction has been successfully completed, a confirmation window will appear.

Your funds will be credited on your real balance instantly.

Where is my money? A Deposit was made to my account automatically

IQ Option company is not able to debit your account without your authorization.Please make sure that a third party doesnt have access to your bank account or e-wallet.

Its also possible that you have several accounts on our website.

If theres any chance that someone got access to your account on the platform, change your password in the settings.

Frequently Asked Questions (FAQ)

How long does it take for the boleto I paid to be credited to my account?

Boletos are processed and credited to your IQ Option account within 2 business days. Please note that we have different boletos, and they usually vary only in the minimum processing time, being 1 hour for fast boletos and 1 day for the other versions. Remember: business days are only from Monday to Friday.

I paid a fast boleto and it didnt come into my account in 24 hours. Why not?

Please note that the maximum processing time for boletos, even the fastest, is 2 business days! Therefore, it means that there is only something potentially wrong if this deadline has expired. It is common for some to be credited quickly and others not. Please just wait! If the deadline has expired, we recommend contacting us via support.

How long does it take for the deposit I made by bank transfer to arrive in my account?

The standard maximum time limit for bank transfers is 2 business days, and it can take less. However, just as some boletos are processed in less time, others may need all the time of the term. The most important thing is to make the transfer on your own account and place a request through the website/app before making the transfer!

Whats this 72-hour error?

This is a new AML (anti-money laundering) system that we have implemented. If you deposit via Boleto, you must wait up to 72 hours before making a withdrawal. Note that the other methods are not impacted by this change.

Can I deposit using someone elses account?

No. All deposit means must belong to you, as well as the ownership of cards, CPF and other data, as stated in our Terms and Conditions.

What if I want to change the currency of my account?

You can only set the currency once, when you make the first deposit attempt.You will not be able to change the currency of your real trading account, so please make sure you choose the correct one before you click "Proceed to payment".

You can deposit in any currency and it will be automatically converted to the one you chose.

Debit and credit cards. Can I deposit via credit card?

You can use any Visa, Mastercard, or Maestro (with CVV only) debit or credit card to deposit and withdraw money, except for Electron. The card must be valid and registered in your name, and support international online transactions.

How can I unlink my card?

If you want to unlink your card, please click "Unlink Card" right under the "Pay" button when you make your new deposit.

What is 3DS?

The 3-D Secure function is a special method for processing transactions. When you get an SMS notification from your bank for an online transaction, it means that the 3D Secure function is on. If you do not receive an SMS message, contact your bank to enable it.

I have problems depositing via card

Use your computer to deposit and it should work right away!Clear temporary internet files (cache and cookies) from your browser. To do this, press CTRL+SHIFT+DELETE, choose the time period ALL, and select the option to clean. Refresh the page and see if anything changed. For complete instructions, see here.. You can also try using a different browser or a different device.

Deposits might be declined if you entered the wrong 3-D Secure code (the one-time confirmation code sent by the bank). Did you get a code via SMS message from your bank? Please contact your bank if you didnt get one.

This might happen if the "country" field is empty in your information. In this case, the system doesnt know what payment method to offer, because available methods differ by country. Enter your country of residence and try again.

Some deposits might be declined by your bank if they have restrictions on international payments. Please contact your bank and check this information on their side.

You are always welcome to make deposits from an e-wallet instead.

We support the following: Skrill, Neteller.

You can easily register with any of them online for free, and then use your bank card to add money to the e-wallet.

How to Trade CFD instruments at IQ Option

New CFD types available on the IQ Option trading platform include CFDs on stocks, Forex, CFDs on commodities and cryptocurrencies, ETFs.

The trader’s goal is to predict the direction of the future price movement and capitalize on the difference between current and future prices. CFDs react just like a regular market, if the market goes in your favor then your position is closed In The Money. In case market goes against you, your deal is closed Out Of The Money. The difference between Options trading and CFD trading is that your profit depends on the difference between entry price and closing price.

In CFD trading there is no expiration time but you are able to use a multiplier and set stop/loss and trigger a market order if the price gets a certain level.

CFDs on Crypto

In the past month cryptocurrency has made a serious leap and it seems that it is still reaching for new heights. With this crypto trend, though no trend lasts forever, crypto trading is becoming more and more popular. Today we are going to learn more about trading CFDs on cryptocurrencies on the IQ Option platform.

What is Crypto?

It seems that everyone knows the names of big cryptocurrencies – Bitcoin, Etherium, Ripple, Litecoin and so on. Many traders have already had some experience trading these currencies, or even purchasing them to hold on a long-term basis. But what is a cryptocurrency and what is the reason for their fall or rise in value?Cryptos are digital currencies, which means that they don’t have a physical form like paper money. One main feature that most cryptocurrencies have is that they are not issued by a central authority, which, theoretically, makes them immune to any manipulation or government interference. Many cryptocurrencies are based on the blockchain technology where the security of transactions is ensured by confirmations. As cryptocurrencies get accepted as a payment method, their popularity as a secure, anonymous and decentralized currency grows.

Cryptocurrency terms

As in any area, crypto trading has its own important rules and many terms that traders have to know in order to follow the market and understand the conditions well. Here are some of the most commonly used terms:Order – an order placed on the exchange to purchase or sell the cryptocurrency

Fiat – regular money, issued and supported by a state (like for example USD, EUR, GBP and so on)

Mining – processing and decrypting crypto transactions, with the purpose of getting new cryptocurrency

HODL – a misspelling of “hold” that stuck around with the meaning of purchasing cryptocurrency with the intention to keep it for a long time, with the expectation of the price growing

Satoshi – 0,00000001 BTC – the smallest part of a BTC, it can be compared to a cent in USD

Bulls – traders who believe that the price will rise and prefer to buy at low price to sell at a higher value later

Bears – traders who believe the asset price will decrease and may possibly benefit from the asset value going down

How to trade CFDs on Crypto with IQ Option?

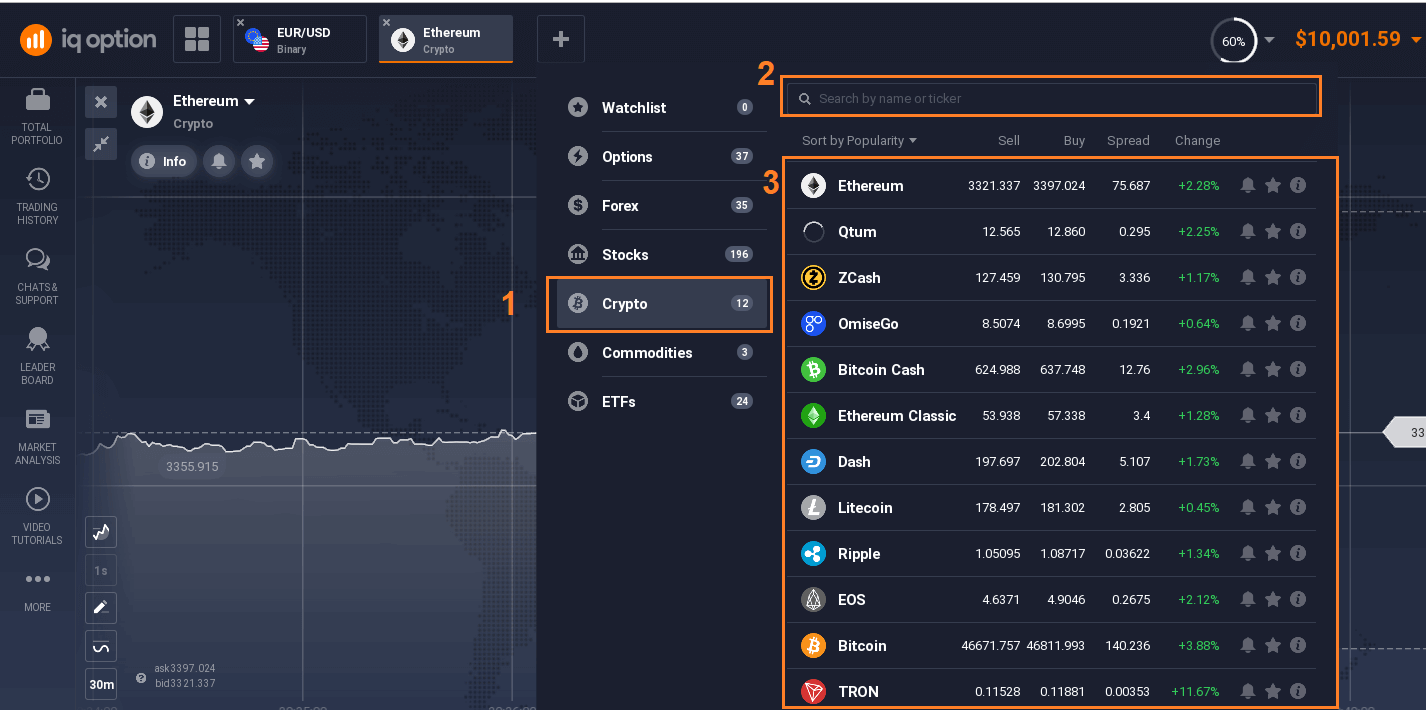

Cryptocurrencies on IQ Option are provided as CFD-based trading. It means that when traders open deals, they make a prediction regarding the change in the price of the asset. Traders may speculate on the changes in price, however, they do not own the crypto coin itself.Here is a step-by-step explanation of CFD crypto trading on the IQ Option platform:

1. To begin trading on cryptocurrencies, you may open the traderoom and click the plus sign at the top to find the asset list

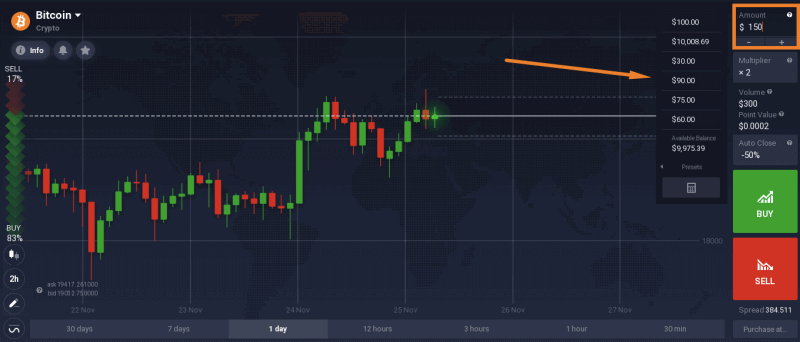

2. Find the cryptocurrency that you are interested in and choose the amount that you wish to invest in a deal

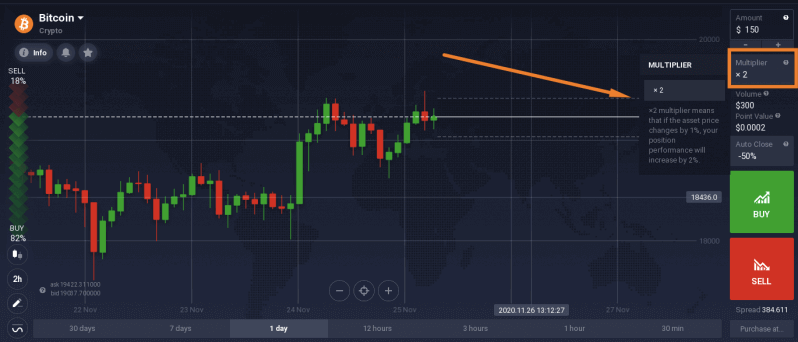

3. Note that cryptocurrencies are traded with a multiplier

The multiplier is an analogue of standard leverage. It provides you with the possibility of higher outcome, although it increases the possible risk of loss.

Based on your investment and the chosen multiplier, you will see the total trading volume of your deal. The trading volume is the amount which the outcome of the deal will depend on.

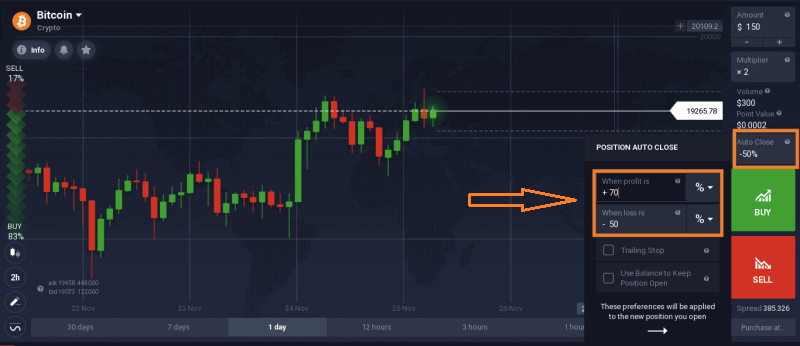

4. The last step before opening a deal is to set autoclose levels in order to adjust the deal to your preferred risk management approach

Note that a stop loss level of 50% is set to all deals automatically. It is possible to reduce this level (for instance, set it at 30%).

If a trader wishes to increase the level, they may utilize their balance funds in order to keep the deal open longer, even after the level of -50% is reached. A trailing stop loss may also be used in order to secure certain outcomes in case of a positive price change.

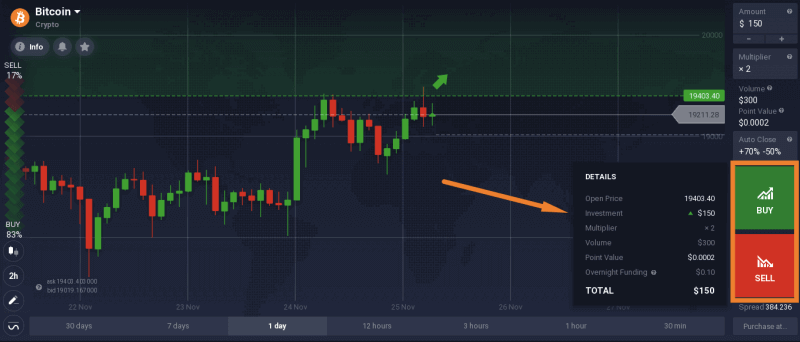

5. To open a deal, a trader will need to click the Buy or Sell button, depending on the expected price change: up or down respectively

When a trader clicks one of the buttons, the details of the deal they are about to open are available: the open price, investment, multiplier, volume, point value as well as the overnight charges. This way it is possible to double check all of the information before confirming the deal.

Market analysis

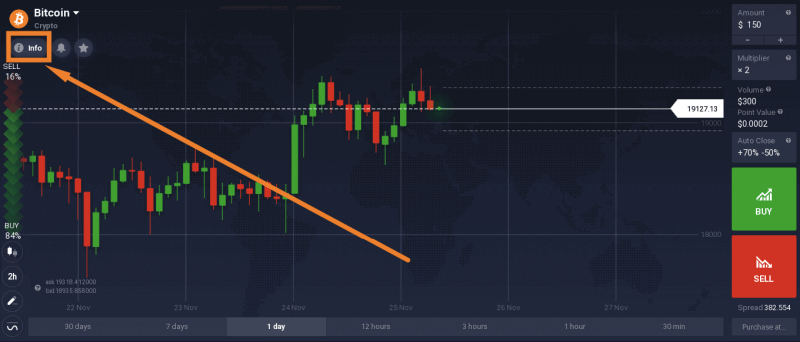

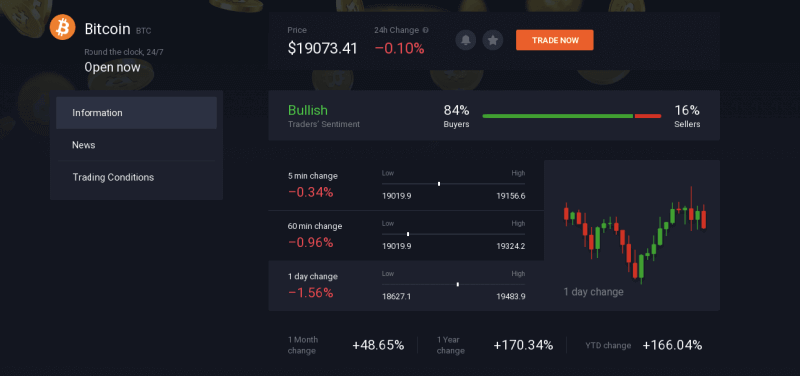

To make a decision regarding buying or selling of the cryptocurrency, traders may use technical indicators provided on the platform, or check out the “Info” section available for every asset in the traderoom.

This section displays the information about the current trend tendency (bearish or bullish), the summary of indicators’ signals and a lot more useful information that could assist a trader in making a well-informed decision.

You may also find the latest and most relevant updates about the asset in the “News” section. Though this section cannot replace a trader’s own analysis, it may help with forming a full picture of how the asset and the industry is doing.

CFDs on Stocks

Traders, working with IQ Option, have the opportunity to trade shares of the world’s most renowned and powerful corporations with the help of an instrument called CFD. The three letters stand for “contract for difference”. By buying the contract, a trader does not invest his funds in the company itself. Rather, he is making a prediction regarding future price movements of the asset at hand. Should the price move in the right direction, he will receive profit proportional to the degree of the asset price change. Otherwise, his initial investment will be lost.CFDs are a good way of trading shares without turning to shares themselves. Stock trading usually involves hassle that can be easily avoided when trading options. Stock brokers do not offer a wide range of investment instruments. On the contrary, when trading with IQ Option, you can trade equity, currency pairs and cryptocurrencies — all in one place. The latter makes trading less time-consuming and, therefore, more effective and comfortable.

How to Trade CFD on Stocks

This is how to trade CFDs on stocks on the IQ Option platform:1. Click the “Open New Asset” button in the upper side of the screen and choose ‘Stocks’ from the list of available options. Then choose the company you want to trade. Analyze the price chart using technical analysis tools. Don’t forget to take into account fundamentals factors, as well. Then determine the trend direction and predict its future behavior in the foreseeable future.

2. Set the amount of money you want to invest in this particular deal. Remember that in accordance with prominent risk management practices, you are not supposed to allocate your entire capital to a single deal.

3. Choose a multiplier and set up the auto closing (optional). A multiplier will increase both the potential return and risk involved. By opening a $100-worth deal with a multiplier of x5 you will get the same results as if you were investing $500. It applies to both profits and losses. Auto closing will let you close the deal automatically, whether to grab your earnings or manage your losses.

4. Now, depending on your forecast, choose either “Buy” or “Sell”. When the time is right, close the deal. The bigger the difference between the opening price and the current price (if the trend direction was predicted correctly), the higher the potential profit. Keep in mind that your deal will be subject to an overnight fee, so don’t keep it open for too long.

CFDs on Forex

Forex may seem complicated upon the first look, however, learning the important principles of it doesn’t take a lot of time. It is a big topic, but knowing just the main concepts may allow a trader to grasp the basics of Forex trading.In this part, we will learn what Forex means, how to understand the Forex chart and what analysis tools IQOption offers right in the traderoom for the trader’s convenience.

What is Forex?

Before going into it, it is important to understand (at least in general terms) what Forex is, why it exists and why it is necessary.The term “Forex” is short for foreign exchange and it is often referred to as simply FX. The foreign exchange market is the largest and most liquid market in the world. It is decentralized: it is not just one place, but rather a system of stable economic and organizational relations between banks, brokers and individual traders with the goal of speculation on foreign currency (buying, selling, exchanging etc.). The reason for forming one global currency market is the developing national currency markets and their interaction.

The foreign exchange market does not set an absolute value for a currency, but rather determines its relative value against another currency, this is why in Forex you will always see a pair like EUR/USD, AUD/JPY and so on.

Understanding the chart

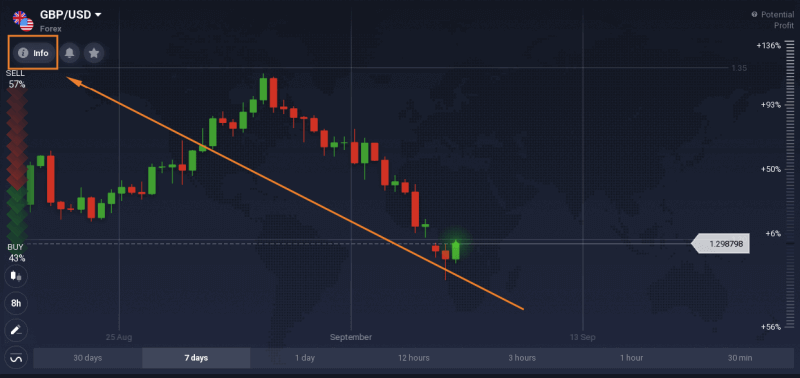

To understand the Forex chart, there are several main points to learn.1. Base and quote currency. The exchange rate always shows two currencies. In the pair, the first currency is called base and the second one is the quote currency. The price of the base currency is always calculated in units of the quote currency. For instance, if the exchange rate for GBP/USD is 1.29, it means that one pound sterling costs 1.29 US dollars.

Based on that, a trader can better understand how the chart is formed. If the chart on GBP/USD, for example, is going up, it means that the price of USD depreciated against GBP. And the other way around, if the rate is going down, it means that the price of USD grows against GBP.

2. Major and exotic currency pairs. All currency pairs can be divided into major and exotic ones. Major pairs involve the major world currencies, like EUR, USD, GBP, JPY, AUD, CHF and CAD. Exotic currency pairs are those that include currencies of developing or small countries (TRY, BRL, ZAR etc.)

3. CFD. On IQ Option, Forex is traded as CFD (Contract For Difference). When a trader opens CFD, they do not own it, however, they trade on the difference between the current value and the value of the asset at the end of the contract (when the deal is closed). This allows a trader to receive his/her outcome in accordance with the difference between the entry price and the exit price.

4. Multiplier. By using a multiplier, the trader gets the ability to manage a position that is greater than the amount of funds at their disposal. However, a higher multiplier also increases the risks involved.

How to Trade CFD on Forex

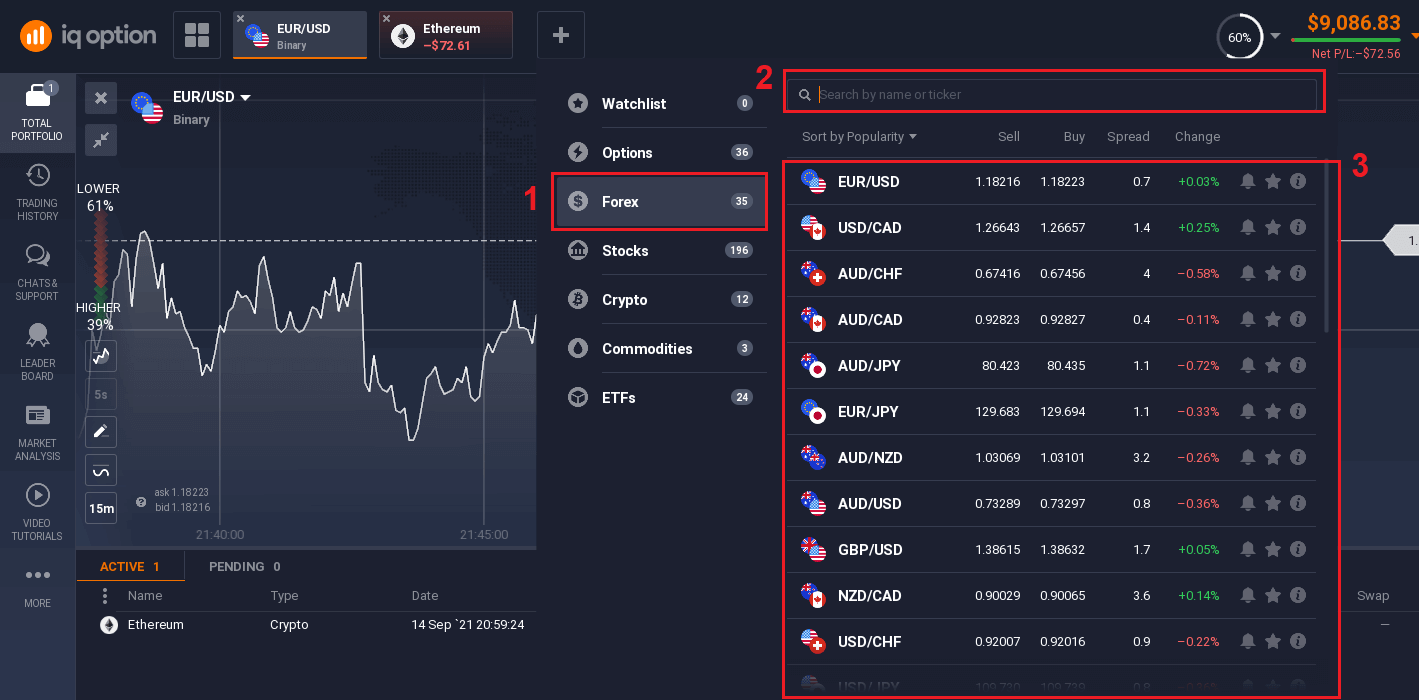

This is how to trade CFDs on Forex on the IQ Option platform:1. Click the “Open New Asset” button in the upper side of the screen and choose ‘Forex’ from the list of available options. Then choose the currency pair you want to trade. Analyze the price chart using technical analysis tools. Don’t forget to take into account fundamentals factors, as well. Then determine the trend direction and predict its future behavior in the foreseeable future.

2. Set the amount of money you want to invest in this particular deal. Remember that in accordance with prominent risk management practices, you are not supposed to allocate your entire capital to a single deal.

3. Choose a multiplier and set up the auto closing (optional). A multiplier will increase both the potential return and risk involved. By opening a $100-worth deal with a multiplier of x5 you will get the same results as if you were investing $500. It applies to both profits and losses. Auto closing will let you close the deal automatically, whether to grab your earnings or manage your losses.

4. Now, depending on your forecast, choose either “Buy” or “Sell”. When the time is right, close the deal. The bigger the difference between the opening price and the current price (if the trend direction was predicted correctly), the higher the potential profit. Keep in mind that your deal will be subject to an overnight fee, so don’t keep it open for too long.

CFD trading may seem easy due to low number of variables involved. However, it is as difficult, as it could be rewarding (if done correctly). Dedicating enough time to the company you are about to trade and learning how to use technical analysis tools in advance is always better than . Dive into the engaging world of CFD trading right now.

Analysis tools for Forex

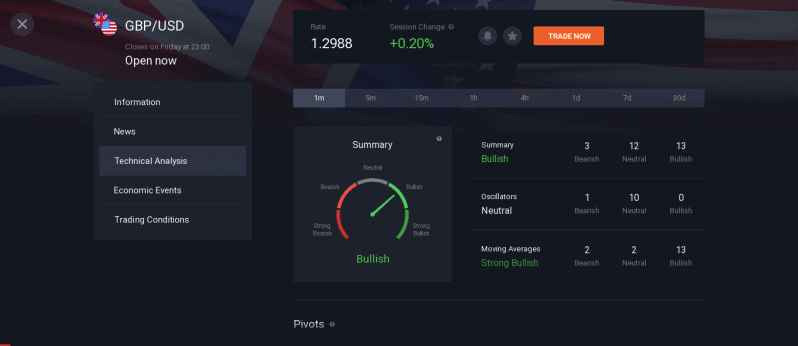

When a trader opens a deal on Forex on the IQOption platform, they make a prediction regarding the price development and they can benefit in case of a correct prediction. That is why a trader has to learn how to analyze the chart in an effective way.On the IQOption platform, every trader can find a lot of information regarding any asset, to do that, one just needs to click on the “Info” button under the name of the asset.

The button opens an entire section with plenty of information and analysis for the asset. It is possible to find general information about the currency pair there, as well as the trading conditions, important news that may affect the price, technical analysis and economic events.

Of course, this analysis should not replace a trader’s own analysis, however, it can sometimes be useful in order to make a well-informed decision. Besides the analysis offered in the “Info” tab, traders may also use the indicators and graphical tools in the traderoom.

As Forex is a complex tool, a trader may use the Practice balance in order to learn and improve their approach. Novice traders may want to implement a strong risk management technique, as well, especially at the very beginning.

Frequently Asked Questions (FAQ)

What is the best time to choose for trading?

The best trading time depends on your trading strategy and a few other factors. We recommend that you pay attention to the market schedules, since the overlap of the American and European trading sessions makes prices more dynamic in currency pairs such as EUR/USD. You should also follow market news that might affect the movement of your chosen asset. Its better not to trade when prices are highly dynamic for inexperienced traders who dont follow the news and dont understand why the price is fluctuating.

How does a multiplier work?

CFD trading offers the usage of a multiplier which can help a trader to control the position that exceeds the amount of money invested in it. The potential profitability (as well as risks) will also be magnified. Investing $100 a trader may get the return that is comparable to a $1000 investment. That’s the opportunity a multiplier can offer. However, remember that the same goes with potential losses as these would be multiplied as well.

How to use Auto Close Settings?

Stop-loss is an order that a trader sets to limit the losses in a particular open position. Take-profit works in much the same way, letting a trader lock in profit when a certain price level is reached. You can set the parameters in percentage, amount of money or asset price: example. You will find the detailed information here.

How to calculate profit in СFD trading?

If a trader opens a long position, the profit is calculated according to the formula: (Closing price / Opening price - 1) x multiplier x investment. If a trader opens a short position, the profit is calculated according to the formula (1-closing price/opening price) x multiplier x investmentFor example, AUD / JPY (Short position): Closing price: 85.142 Opening price: 85.173 Multiplier: 2000 Investment: $2500 The profit is (1-85.142 / 85.173) X 2000 X $2500 = $1.819.82