How to Trade Digital Options on IQ Option

What is Digital Options in IQ Option?

Digital Options trading is similar to All-or-Nothing Options trading. The main distinctive feature is the profitability and the risks of each deal that depend on a manually chosen strike price on the right side of the chart.- Potential profit on Digital Options can be up to 900%. However, an unsuccessful trade will result in loss of the investment.

- The closer strike price is to the current price of the asset - the lower your risks and potential profit are

Note that digital options will expire-in-the-money only if the actual price is not identical to the strike one. For call options it should exceed the strike price by at least one pip, for put options it should fall behind the strike price by at least one pip.

How to Trade Digital Options?

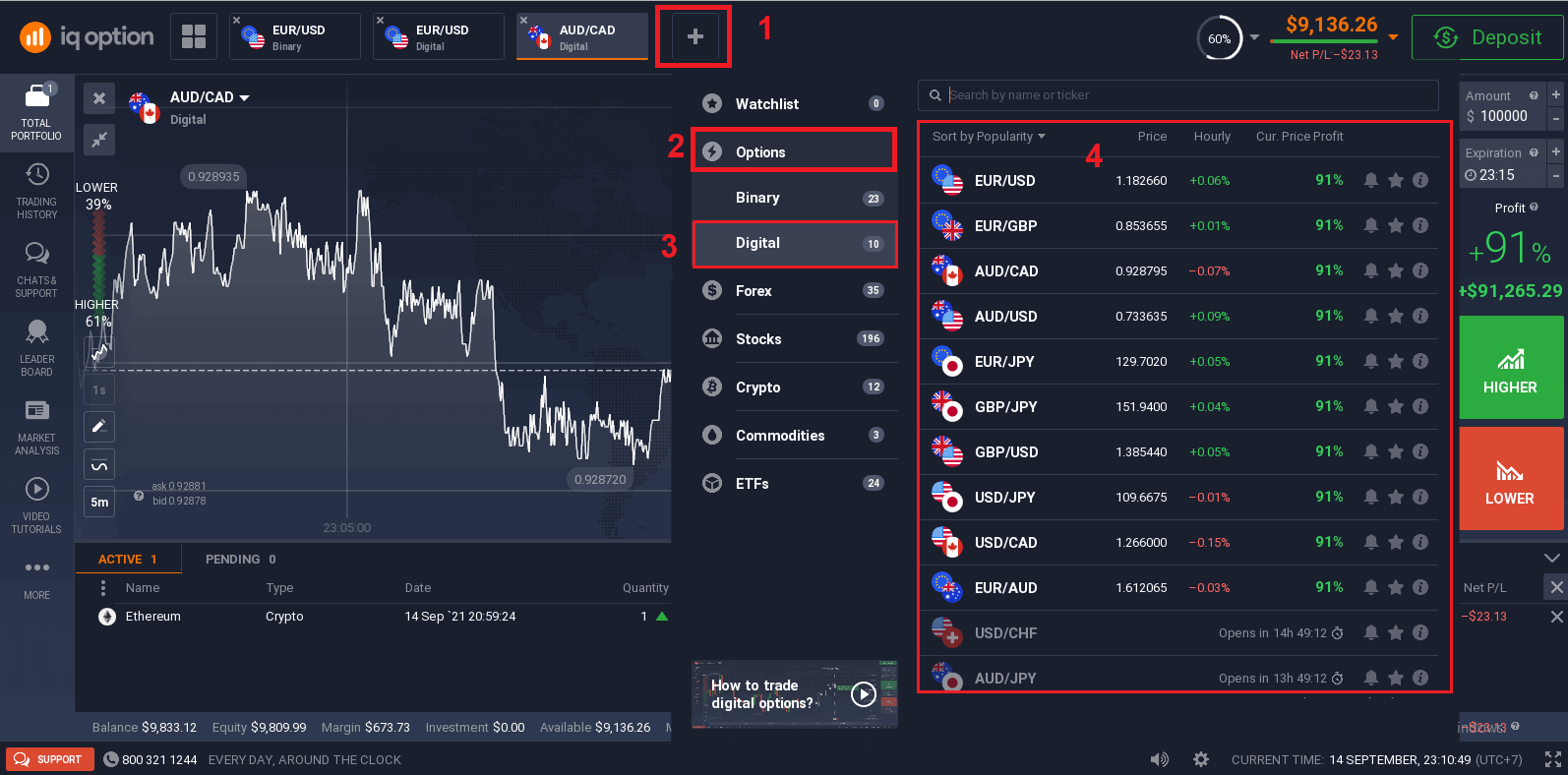

1. Choose asset for trading

- You can scroll through the list of assets. The assets that are available to you are colored white. Click on the assest to trade on it.

- You can trade on multiple assets at once. Click on the “+” button right from the asset section. The asset you choose will add up.

All trades close with the profitability that was indicated when they were opened.

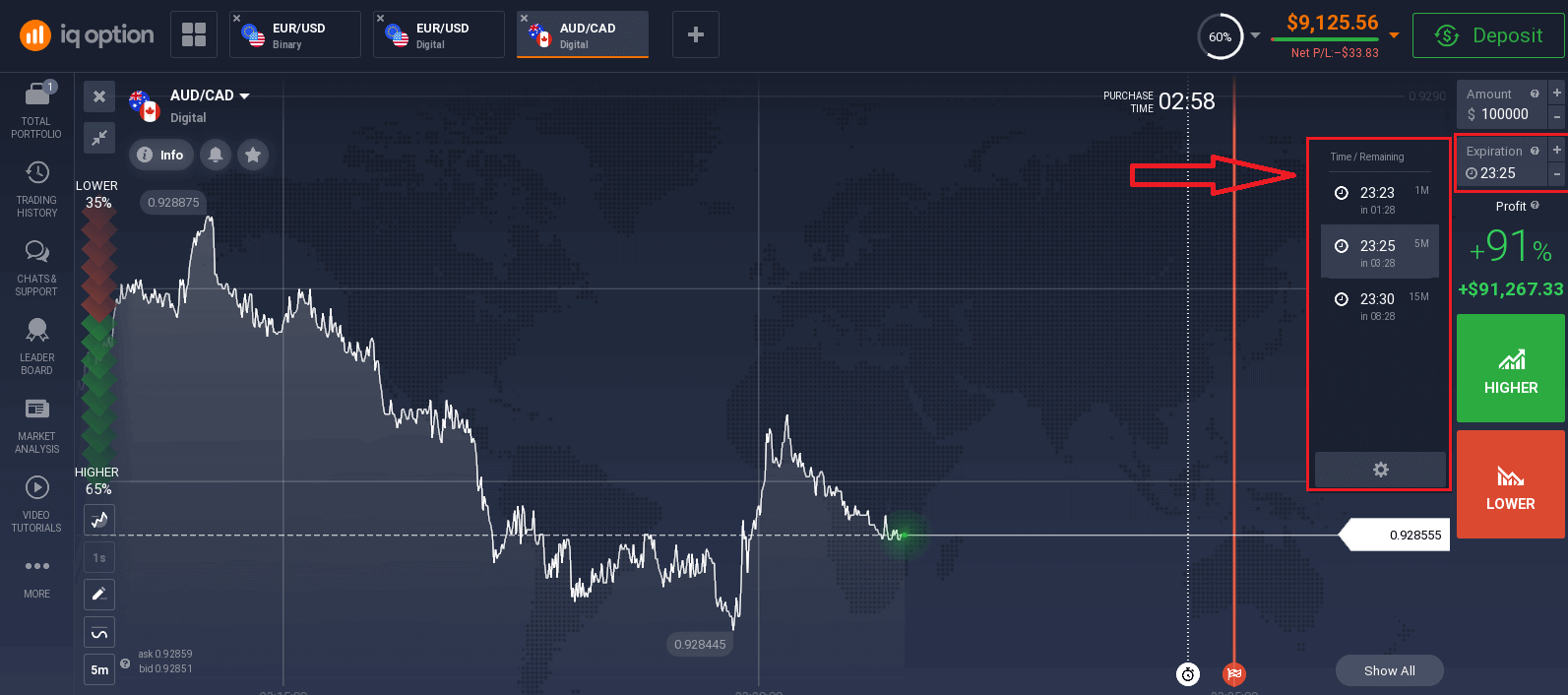

2. Choose an Expiration Time

The expiration period is the time after which the trade will be considered completed (closed) and the result is automatically summed up.

When concluding a trade with digital options, you independently determine the time of execution of the transaction.

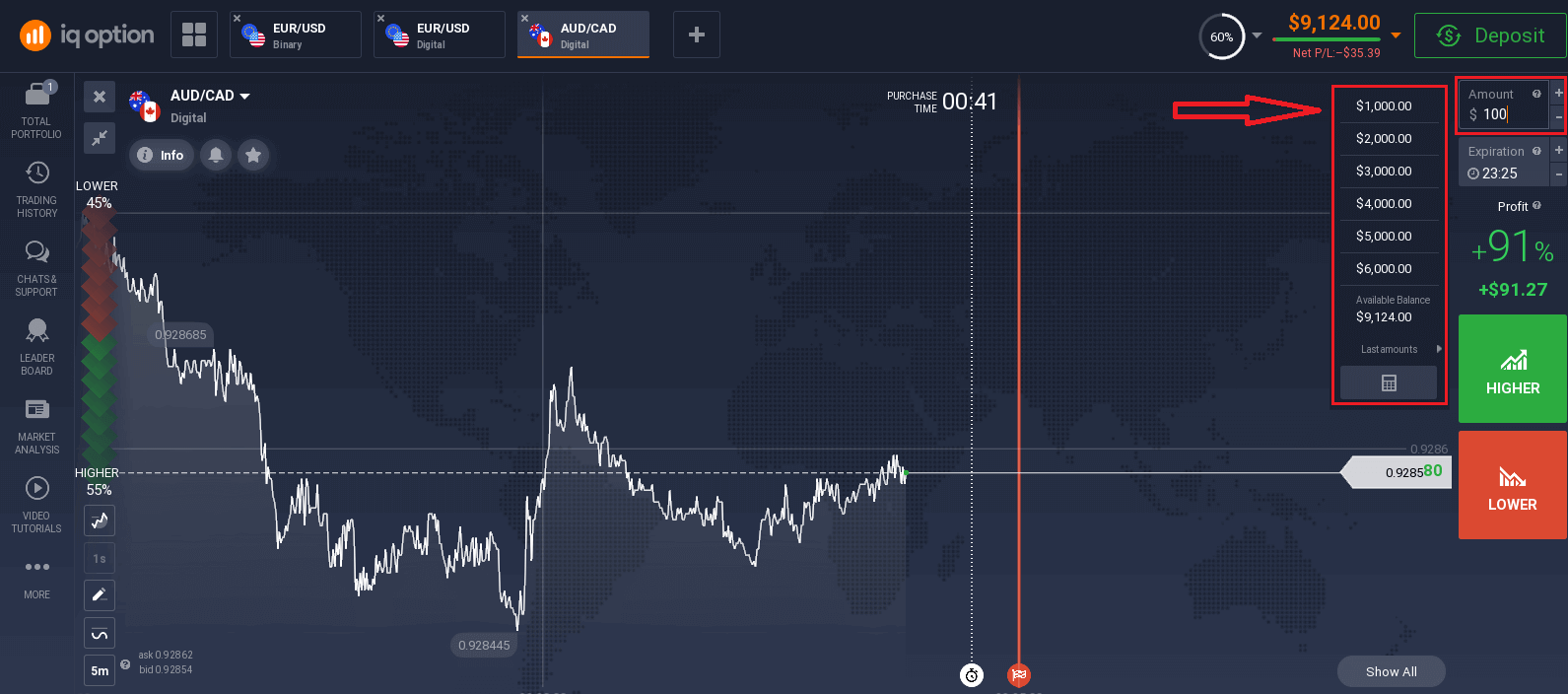

3. Set the amount you’re going to invest.

The minimum amount for a trade is $1, the maximum – $20,000, or an equivalent in your account currency. We recommend you start with small trades to test the market and get comfortable.

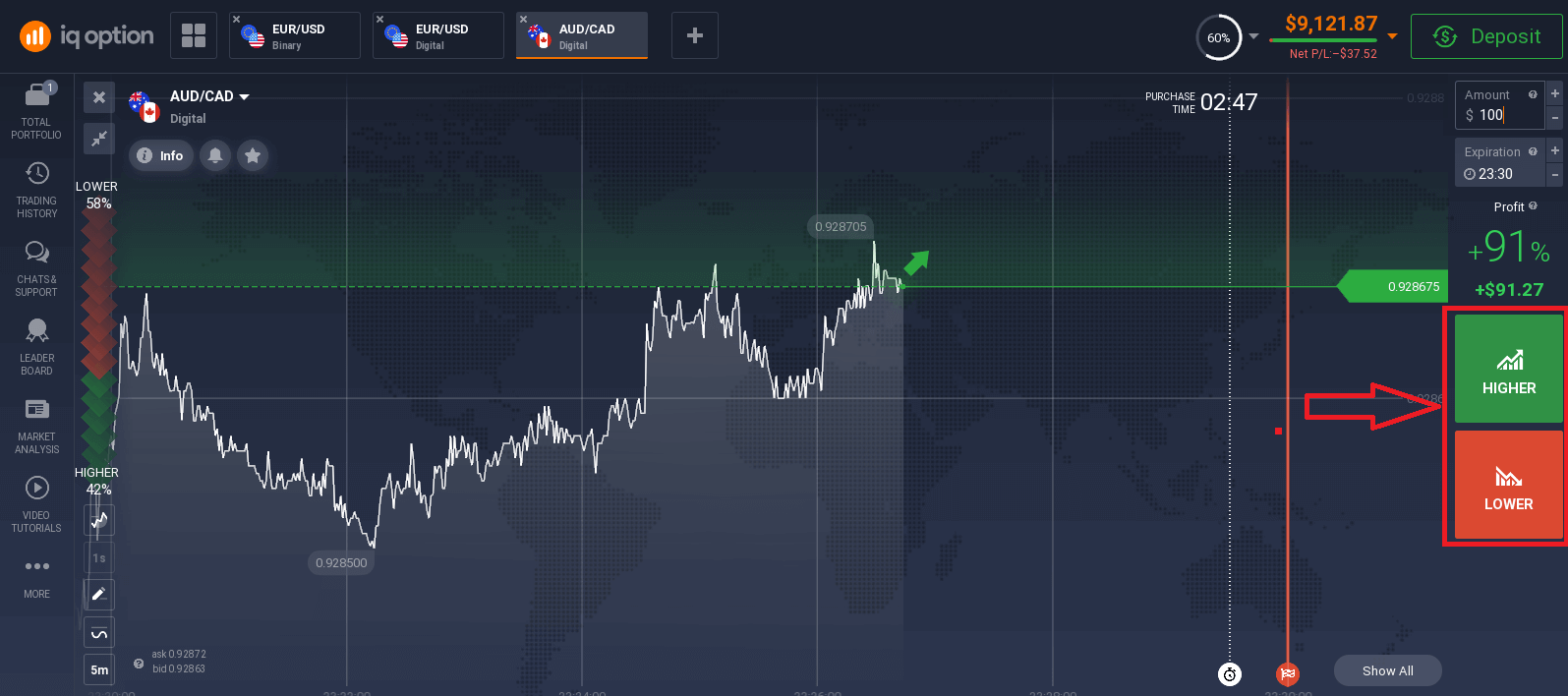

4. Analyze the price movement on the chart and make your forecast.

Choose Higher (Green) or Lower (Red) options depending on your forecast. If you expect the price to go up, press "Higher" and if you think the price to go down, press "Lower"

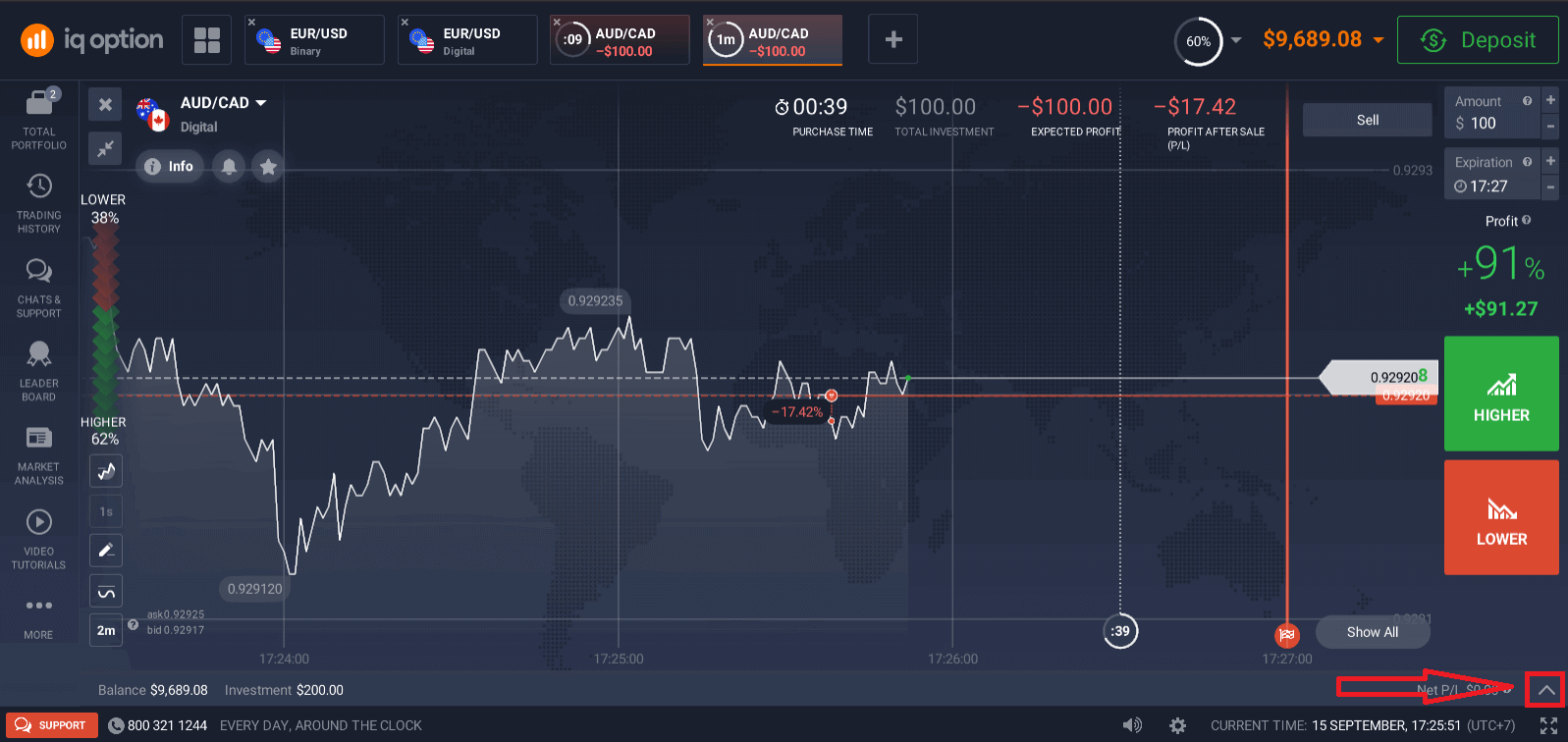

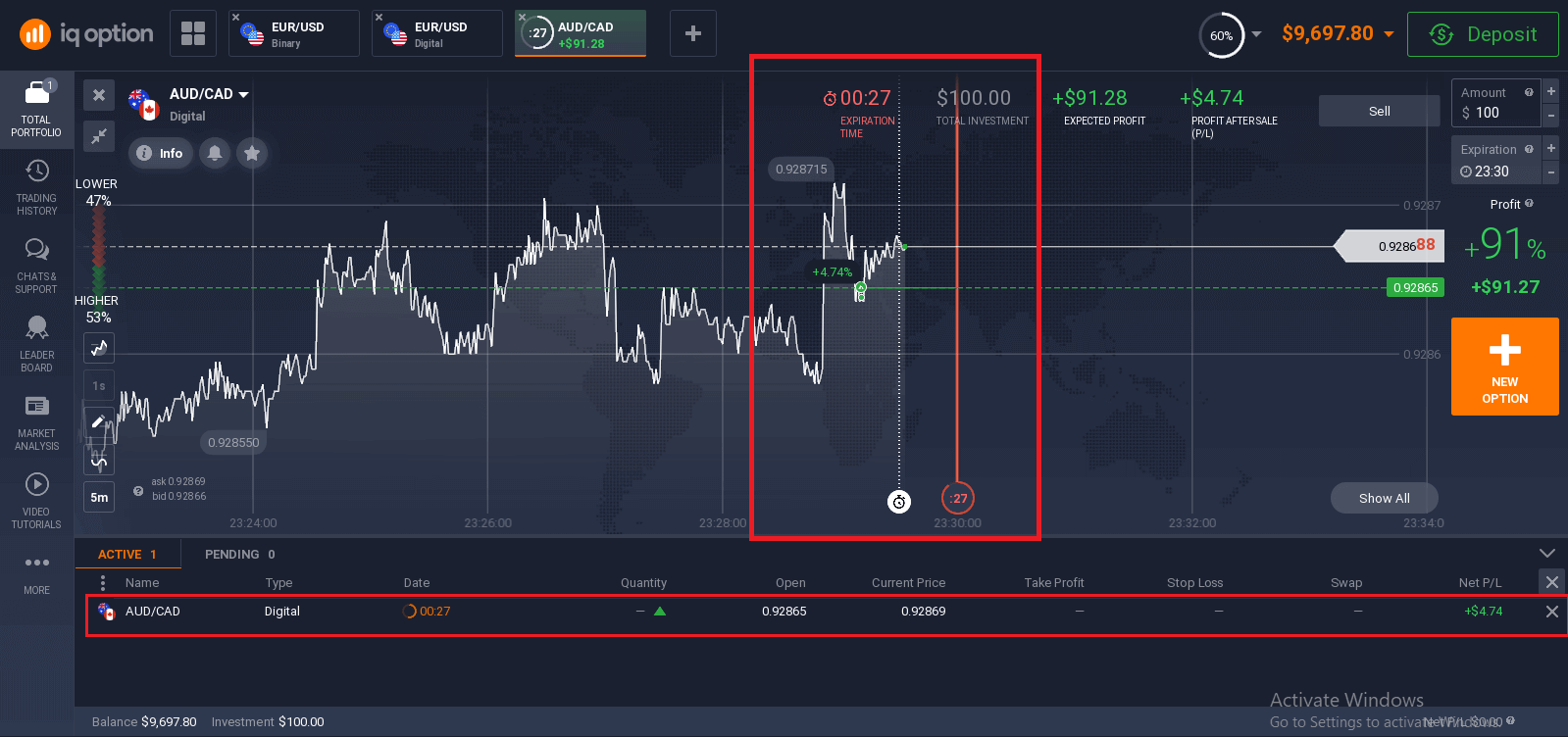

5. Wait for the trade to close to find out whether your forecast was correct. If it was, the amount of your investment plus the profit from the asset would be added to your balance. If your forecast was incorrect – the investment would not be returned.

You can monitor the Progress of your Order under The Trades

The chart shows two lines marking points in time. The purchase time is the white dotted line. After this time, you cant buy an option for the selected expiration time. The expiration time is shown by the solid red line. When the transaction crosses this line, it closes automatically and you take either a profit or a loss for the result. You can choose any available expiration time. If you have not opened a deal yet, both white and red lines will be moving together to the right to mark the purchase deadline for the chosen expiration time.

Frequently Asked Questions (FAQ)

I had a tie on Digital Options and I still lost my investment. Why was that?

Digital Options function differently from All-or-Nothing Options. In the case of Digital Options, you must select a Strike Price, which is the price the asset must break through to make your transaction profitable. If the opening value equals to the closing one, the trade will close at loss since the Strike Price is not reached.

What is the best time to choose for trading?

The best trading time depends on your trading strategy and a few other factors. We recommend that you pay attention to the market schedules, since the overlap of the American and European trading sessions makes prices more dynamic in currency pairs such as EUR/USD. You should also follow market news that might affect the movement of your chosen asset. Its better not to trade when prices are highly dynamic for inexperienced traders who dont follow the news and dont understand why the price is fluctuating.

How many options can I buy per expiration?

We dont restrict the number of options you can buy for an expiration or an asset. The only limitation is in the exposure limit: if traders have already invested a large amount in the asset you have selected, the amount you invest is limited by this exposure limit. If you are working in an account with real funds, you can view the investment limit for each of the options on the chart. Click on the box where you enter the amount.

What is the minimum price of an option?

We want trading to be available to everyone. The minimum investment amount for today trading conditions can be found on the Company’s trading platform/website.

What are the profit after sale and the expected profit?

All-or-Nothing Options and Digital Options are only available to Professional Clients.As soon as you buy a Put or Call option, three numbers appear on the right top side of the chart:

Total investment: how much you have invested into a deal

Expected Profit: possible result of the transaction if the chart point at the expiration line ends up at the same place where it is now.

Profit after Sale: If it is red, it shows you how much of the invested amount you will lose your balance after sale. If it is green, it shows you how much profit you will get after sale.

Expected Profit and Profit after Sale are dynamic, as they change depending on several factors including current market situation, how close the expiration time is and the current price of the asset.

Many traders sell when they arent sure that the transaction will give them a profit. The selling system gives you the chance to minimize losses on doubtful options.

Why is Sell button (prescheduled option closing) inactive?

For All-or-Nothing options the Sell button is available from 30 minutes until expiration to 2 minutes until expiration.If you trade Digital Options, Sell button is always available.